28+ loan to debt ratio mortgage

Do you have a lot of debt. Ideally lenders prefer a debt-to-income ratio lower.

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less.

. A high debt-to-income ratio can result in a turned-down mortgage application. Luckily there are ways to get. Web Here are debt-to-income requirements by loan type.

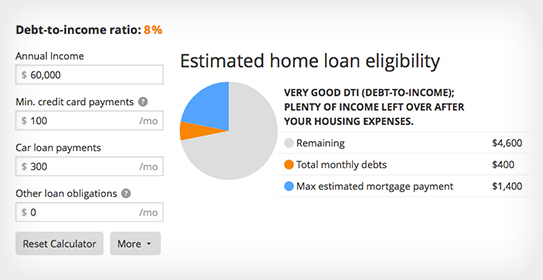

Check How Much Home Loan You Can Afford. Web Your front-end or household ratio would be 1800 7000 026 or 26. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income.

Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower.

Our Mortgage Loan Officer Extraordinaire Coretta. Loan-to-Value Ratio The Loan-to-Value. Web 3 Likes 2 Comments - Ramiza Khan rk_homeloan on Instagram.

Web 28 ratio of mortgage to income Minggu 19 Maret 2023 Edit. Many lenders may even want to see a DTI thats closer to. Contact a Loan Specialist.

Web 3 Likes 1 Comments - AvisSmithRealtor avissmithrealtor on Instagram. Apply Online To Enjoy A Service. Ad Compare Loans Calculate Payments - All Online.

Youll usually need a back-end DTI ratio of 43 or less. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. The loan-to-value ratio is a simple formula that measures the amount of financing used to buy an asset relative to the value.

Web How to get a loan with a high debt-to-income ratio. Web Use our Mortgage Calculator to estimate your interest rates monthly total repayment down payment stamp duty legal fee agent fee plus affordability based on your Debt. From the lenders standpoint a.

Web If you get an 80000 mortgage to buy a 100000 home then the loan-to-value is 80 because you got a loan for 80 of the homes value. Web Theres actually a wide range of good debt-to-income ratios. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Back end ratio looks at your non-mortgage debt percentage. Ad Check Todays Mortgage Rates at Top-Rated Lenders. If your home is highly energy-efficient.

Compare Apply Directly Online. If you have a solid credit score low debt-to-income ratio and money to make a higher down paymen. Compare More Than Just Rates.

Web The threshold for the housing expense ratio set by lenders for mortgage loan approvals is typically equal to 28. Web What Is Loan-to-Value LTV Ratio. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA.

To get the back-end ratio add up your other debts along with your housing expenses. Lenders would like to see the front-end ratio of 28 or less for conventional loans and 31 or. Highest Satisfaction for Mortgage Origination.

Find A Lender That Offers Great Service.

Prepare For The Insurtech Wave

Debt To Income Ratio Crb Kenya

Ex 99 1

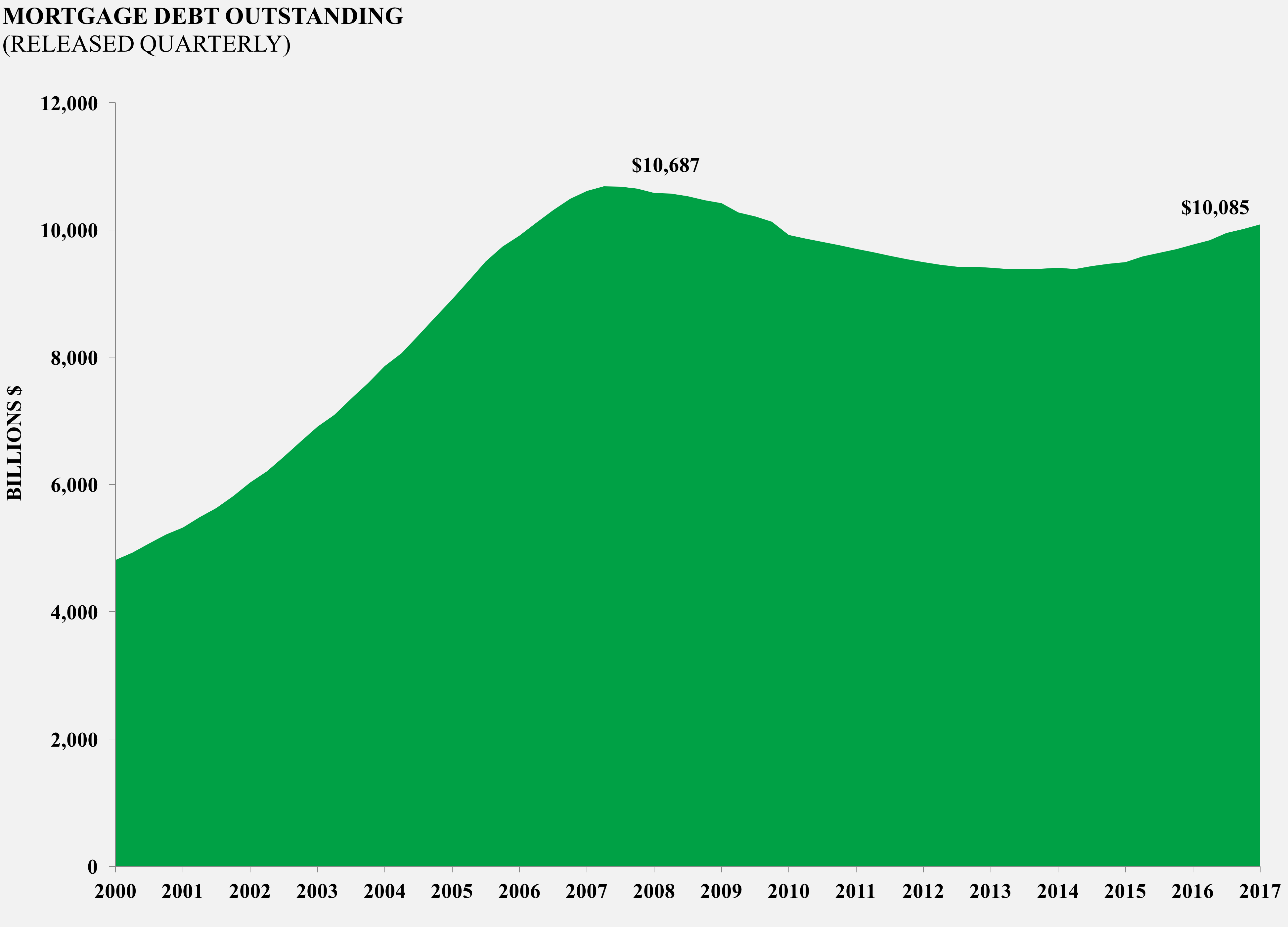

Mortgage Debt Outstanding Aaf

80 Mlo Financial Group Mortgage Real Estate Help Ideas Mortgage Financial How To Plan

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Revolut Business Everything You Need To Know Swoop Uk

The Right Debt To Income Ratio You Need To Buy A House

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

28 36 Rule What It Is How To Use It Example

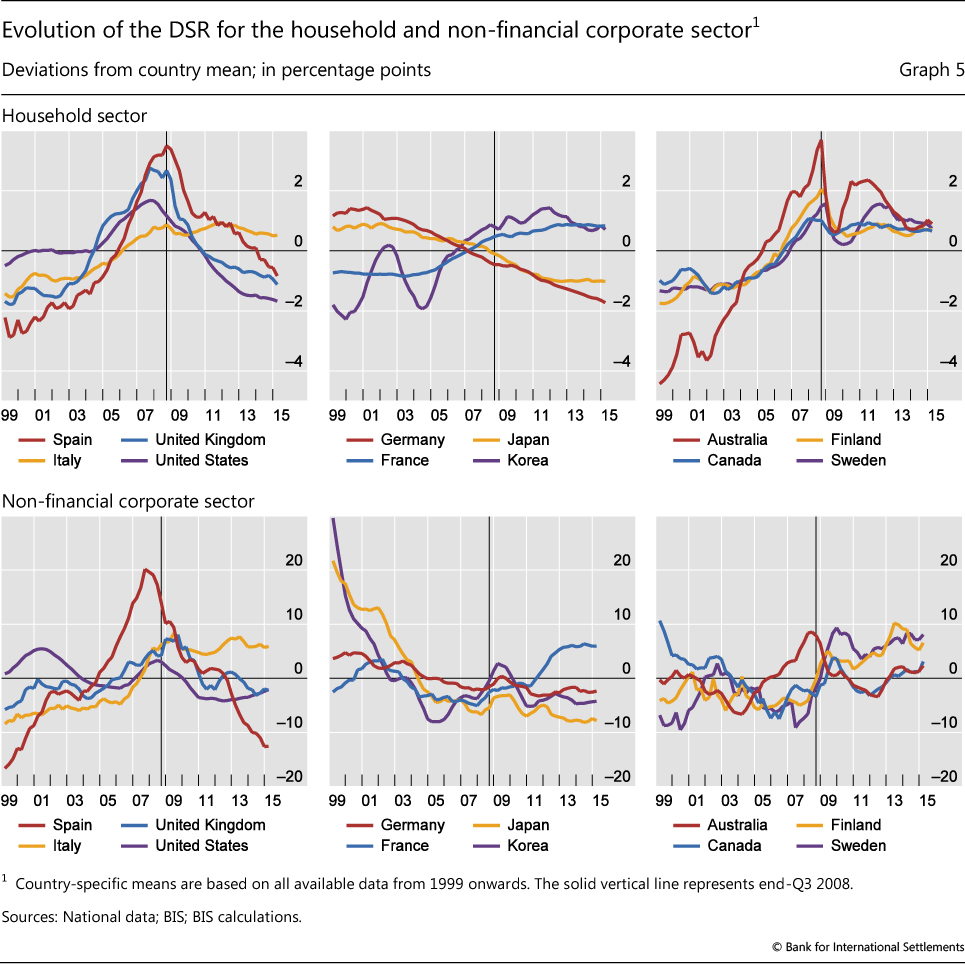

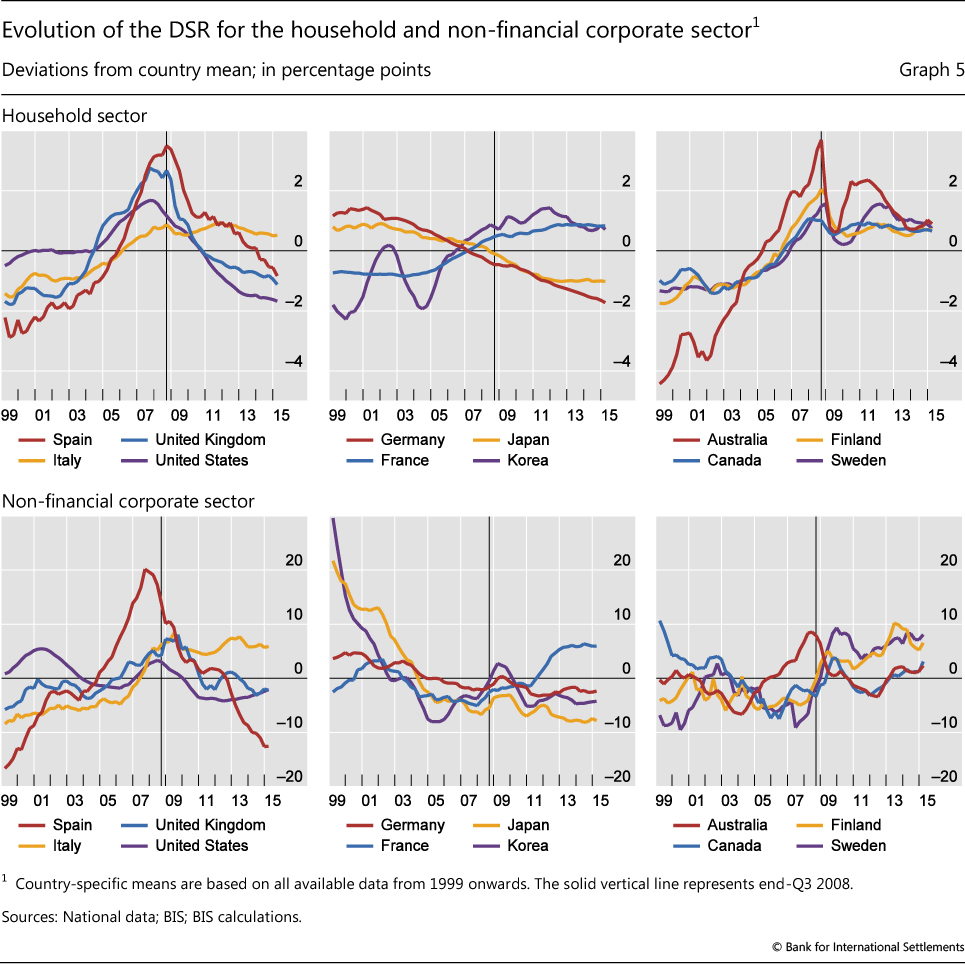

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

Debt To Income Ratio Calculator What Is My Dti Zillow

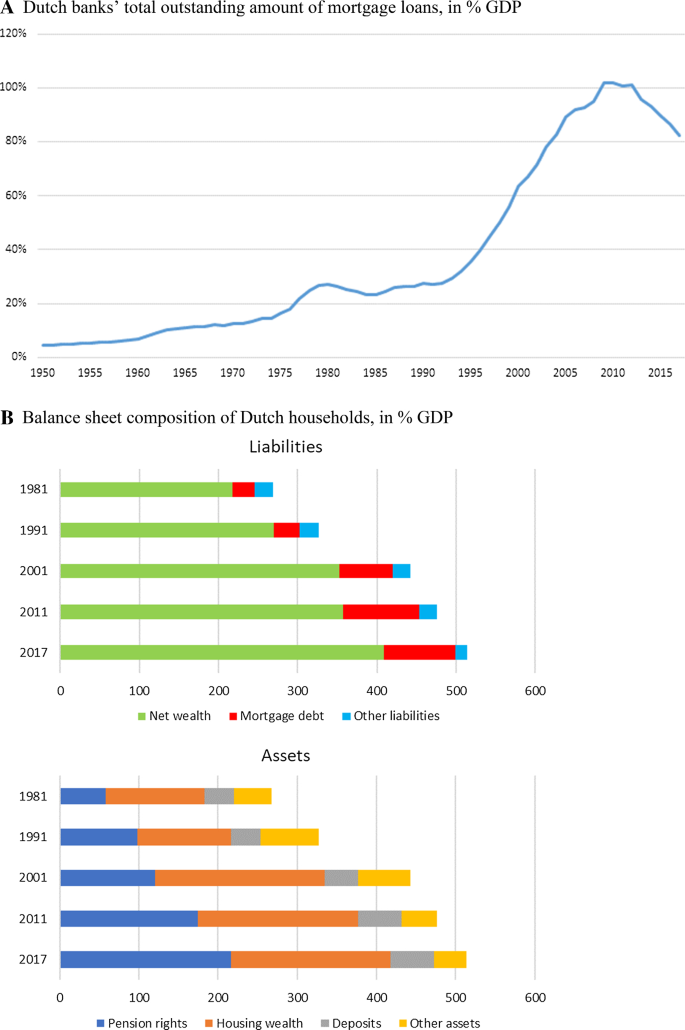

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink